- Published on

Digital wallets (DW) are now the number 1 payment method globally.

- Authors

- Name

- AbnAsia.org

- @steven_n_t

"[EXPERT OPINION BY KRIARIS]

What's behind their dominance and what are the implications? Let's take a look.

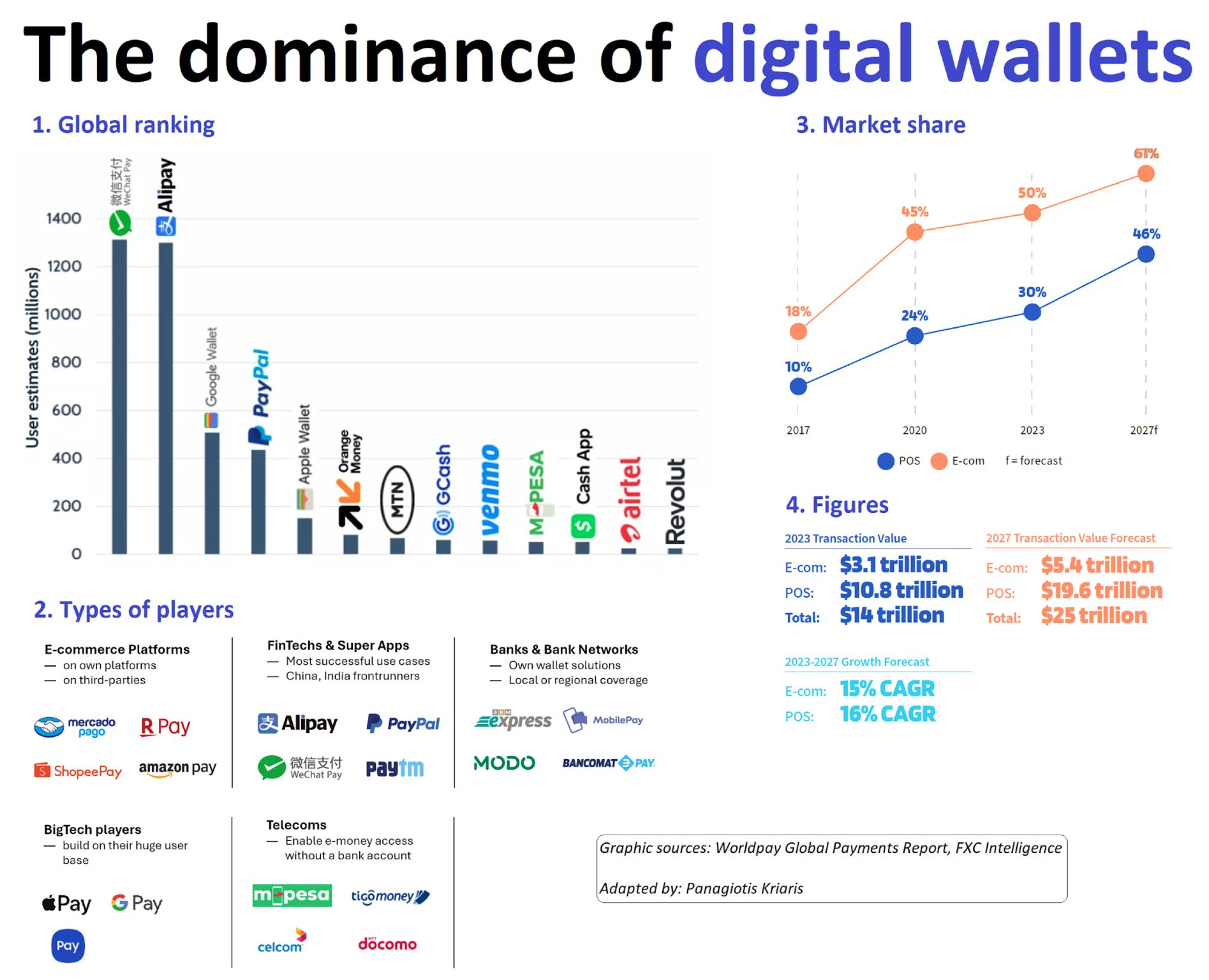

The numbers are revealing (sources: Juniper Research, 2024 Worldpay Global Payments Report):

The number of DW users will exceed 5.2 bn globally in 2026 (+53% vs 2022)

DW are the fastest growing payment method globally with 25 tn by 2027)

50% e-com global share ($3.1 tn)

30% POS global share ($10.8 tn)

But why have DWs become so popular?

Because they have democratized access to #payments, for very difference audiences around the globe, bringing along unique benefits:

Financial inclusion for huge populations (i.e. Africa, Asia) that didn't have other alternatives (there are still 1.7 bn unbanked adults today)

Convenience in the form of user experience, speed, easy onboarding and simple authentication

Low-cost monetization opportunities and higher sales conversion for players across the value chain (providers, merchants, banks, platforms, fintechs)

It was exactly due to their versatile nature that DWs were championed to the fore via very different players:

Bigtechs like Apple, Google and Samsung that wanted to build on their huge user base

#ecommerce platforms like Amazon, Mercado Pago or Rakuten looking to boost their business and create new growth opportunities

Banks looking to compete with new value-chain challengers (fintechs, platforms) on their own (front-end) customer-facing game

#fintech players and Super Apps that used DW as a tool of expansion and market share consolidation

Telecoms seeking to enable e-money access without the need for a bank account

No surprise that DWs are core to the #strategy of most major tech and payment players across the globe. These are some of the use cases showcasing why:

Central storage place for all kinds of cards (debit, credit, prepaid, gift, etc)

SuperApp rails

Instant payouts for gig economy workers (i.e. Uber)

Rails for multi-currency conversion and remittances

Storing, buying and selling crypto currencies

Savings and investment

Loyalty and reward programs (i.e. points, discounts, coupons)

Personalized (i.e. location-based) marketing capabilities

Event ticketing

Promotions and mass personalization

Gaming (virtual currency storage, payments, etc)

Remarks and #trends going forward:

Although DWs were originally built with an e-commerce perspective in mind, it was the in-store space that in many geographies propelled them to the fore via technologies such as QR codes (Asia) or NFC (US, Europe)

Cards are both a DW competitor and enabler

QR codes will become the most popular DW transaction type by 2026 and will be driving POS DW adoption, especially via loyalty and personalization features"

Author

DIGITIZING ASIA, ABN ASIA was founded by people with deep roots in academia, with work experience in the US, Holland, Hungary, Japan, South Korea, Singapore, and Vietnam. ABN Asia is where academia and technology meet opportunity. With our cutting-edge solutions and competent software development services, we're helping businesses level up and take on the global scene. Our commitment: Faster. Better. More reliable. In most cases: Cheaper as well.

Feel free to reach out to us whenever you require IT services, digital consulting, off-the-shelf software solutions, or if you'd like to send us requests for proposals (RFPs). You can contact us at [email protected]. We're ready to assist you with all your technology needs.

© ABN ASIA