- Published on

2024 Global Payments Report

- Authors

- Name

- AbnAsia.org

- @steven_n_t

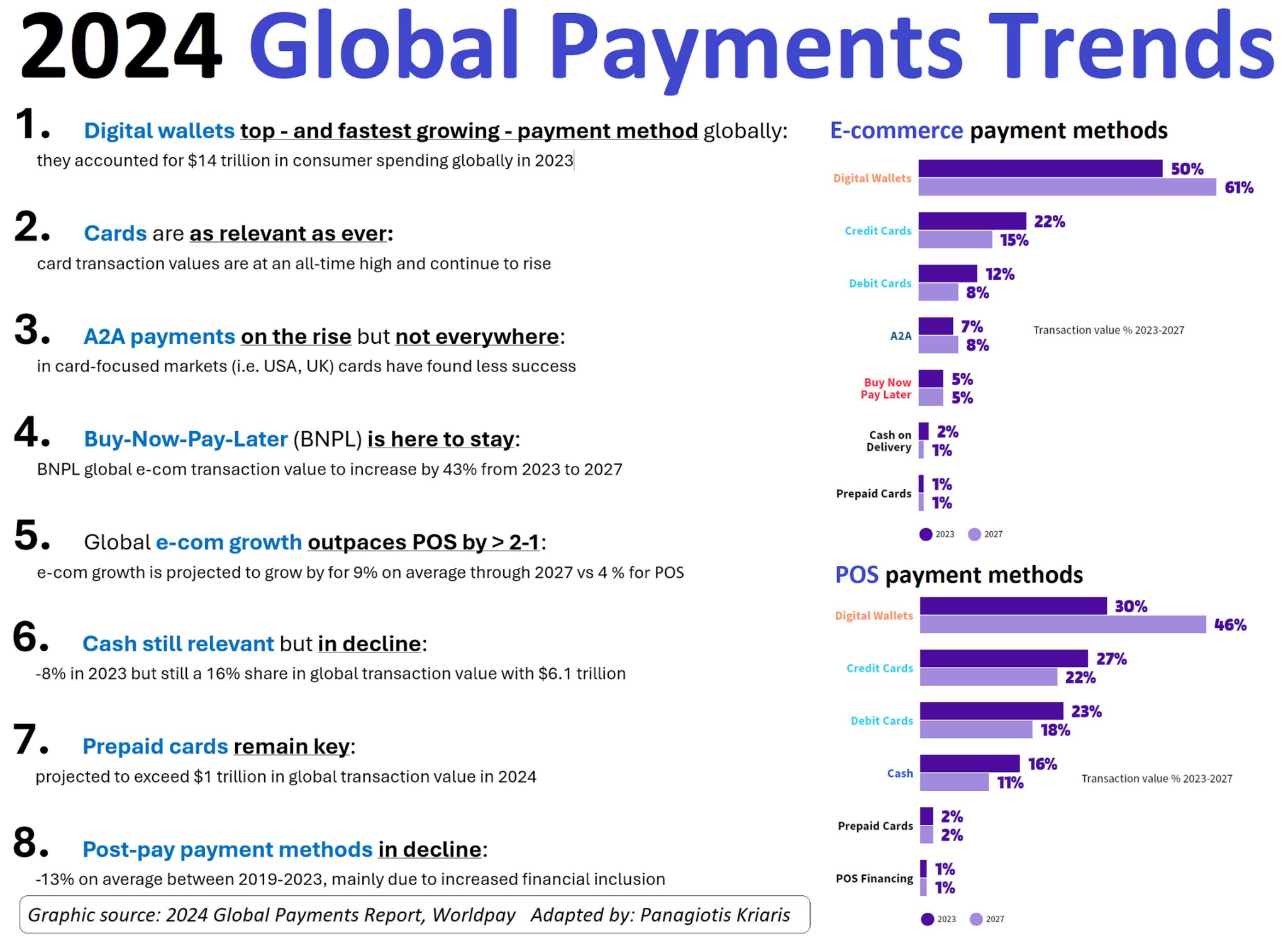

"1. Digital #wallets are the top - and fastest growing - payment method globally:

They represent 25 tn by 2027

50% e-com global share ($3.1 trillion), to increase to 61% by 2027

30% POS global share ($10.8 trillion), to increase to 46% by 2027

Catching up fast in card-dominated markets (Europe, North America)

- #Cards are as relevant as ever:

Have ceded share to digital wallets, but remain relevant

In card-dominated markets, the spend lost is shifting to digital wallets like Apple Pay, Google Pay and PayPal

If card wallets spend is included, share remains flat through 2027

- #A2A payments are on the rise but not everywhere:

A2A schemes have risen mainly in emerging markets (i.e. India, Brazil), due to strong government support and as a means to achieve financial inclusion and to promote digital payments

In advanced markets, A2A grows via collaboration between banks

A2A growth considerably slower in established card markets such as Australia, Canada, the UK and the USA

- Buy-Now-Pay-Later (#BNPL) is here to stay:

BNPL challenges are not due to the business model or declining consumer popularity, but a result of macro and looming regulation

BNPL mainstream adoption by banks, Bigtechs, retailers and platforms

BNPL global e-com transaction value is to increase by 43% from 2023 to 2027 (from 452 bn)

The winners are increasingly those for whom BNPL is not the primary business model

- Global #ecommerce growth outpaces POS by > 2-1:

Global e-com growth slows, yet remains robust

E-com as a % of all commerce continues to rise - 14.4% globally in 2023 and forecast to exceed 17% by 2027

The global e-commerce pie expanded by 10% YoY to reach $6.1 tn in transaction value

- Cash still relevant but in decline:

Globally, cash fell -8% YoY from 6.1 tn in 2023

In 2023, cash was the leading payment method at POS in 12 of the 40 markets - by 2027 5 will remain

- Prepaid cards remain key:

Will exceed $1 tn in global transaction value in 2024

Prepaid cards are thriving today because of the wide range of use cases: private-label gift cards, general purpose reloadable cards, direct deposit payroll, government benefit distribution

- Post-pay payment methods in decline:

The vast majority of post-pay orders are paid for in cash

They accounted for only 0.3% of e-com transaction value globally in 2023 (however 4% in Latin Ameica)

Significant decline over the past years (-13% CAGR between 2019-2023), due to improved financial inclusion, less cash and an increase of digital payments"

Author

AiUTOMATING PEOPLE, ABN ASIA was founded by people with deep roots in academia, with work experience in the US, Holland, Hungary, Japan, South Korea, Singapore, and Vietnam. ABN Asia is where academia and technology meet opportunity. With our cutting-edge solutions and competent software development services, we're helping businesses level up and take on the global scene. Our commitment: Faster. Better. More reliable. In most cases: Cheaper as well.

Feel free to reach out to us whenever you require IT services, digital consulting, off-the-shelf software solutions, or if you'd like to send us requests for proposals (RFPs). You can contact us at [email protected]. We're ready to assist you with all your technology needs.

© ABN ASIA