- Published on

how early-stage investors evaluate your startups investability

- Authors

- Name

- AbnAsia.org

- @steven_n_t

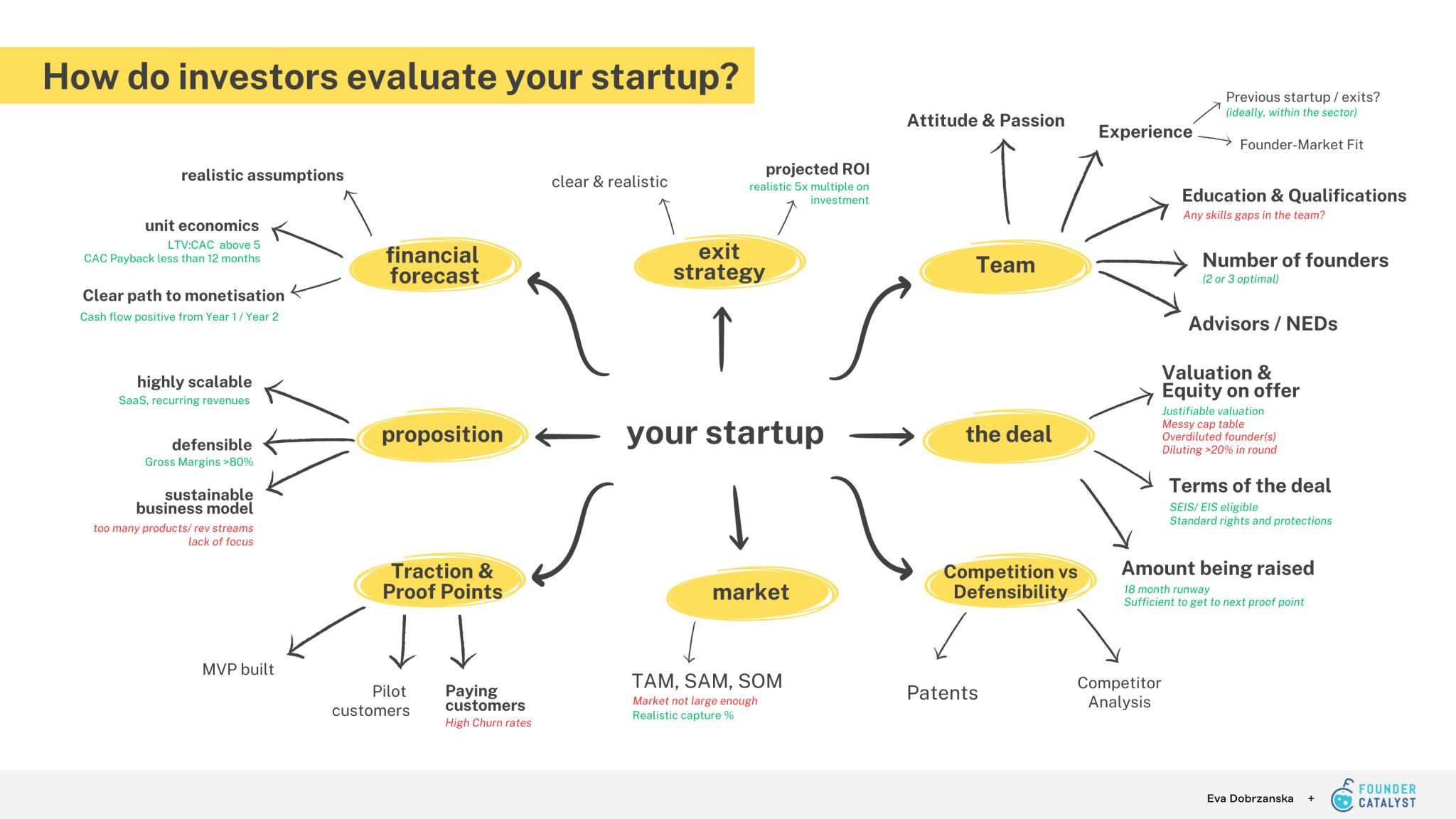

- Team - the most important slide, especially at Pre Seed & Seed

(2) Traction & Proof Points

(3) Market - if you're raising from VCs, your SOM must be large enough for their desired ROI

(4) Proposition - does your solution and its business model make sense?

(5) Competition vs Defensibility - what's your USP?

(6) Financial Forecast - although it's just projections at the early stages, it must be reasonable and all numbers well-justified

(7) The Deal - how much are you raising? At what valuation

(8) Exit Strategy - is there a potential for strong exit?

Author

AiUTOMATING PEOPLE, ABN ASIA was founded by people with deep roots in academia, with work experience in the US, Holland, Hungary, Japan, South Korea, Singapore, and Vietnam. ABN Asia is where academia and technology meet opportunity. With our cutting-edge solutions and competent software development services, we're helping businesses level up and take on the global scene. Our commitment: Faster. Better. More reliable. In most cases: Cheaper as well.

Feel free to reach out to us whenever you require IT services, digital consulting, off-the-shelf software solutions, or if you'd like to send us requests for proposals (RFPs). You can contact us at [email protected]. We're ready to assist you with all your technology needs.

© ABN ASIA