- Published on

SEPA Instant Payments

- Authors

- Name

- AbnAsia.org

- @steven_n_t

"SEPA Instant Payments - A Catalyst For New Developments In The Payments Market

On 19 March 2024, there was published in the Official Journal of the EU (OJ), Regulation (EU) 2024/886 of the European Parliament and of the Council of 13 March 2024 amending the Single Euro Payments Area Regulation, the Cross-Border Payments Regulation, the Settlement Finality Directive and the Second Payment Services Directive as regards instant credit transfers in euro. The Regulation enters into force on the twentieth day following its publication in the Official Journal of the EU (8 April 2024).

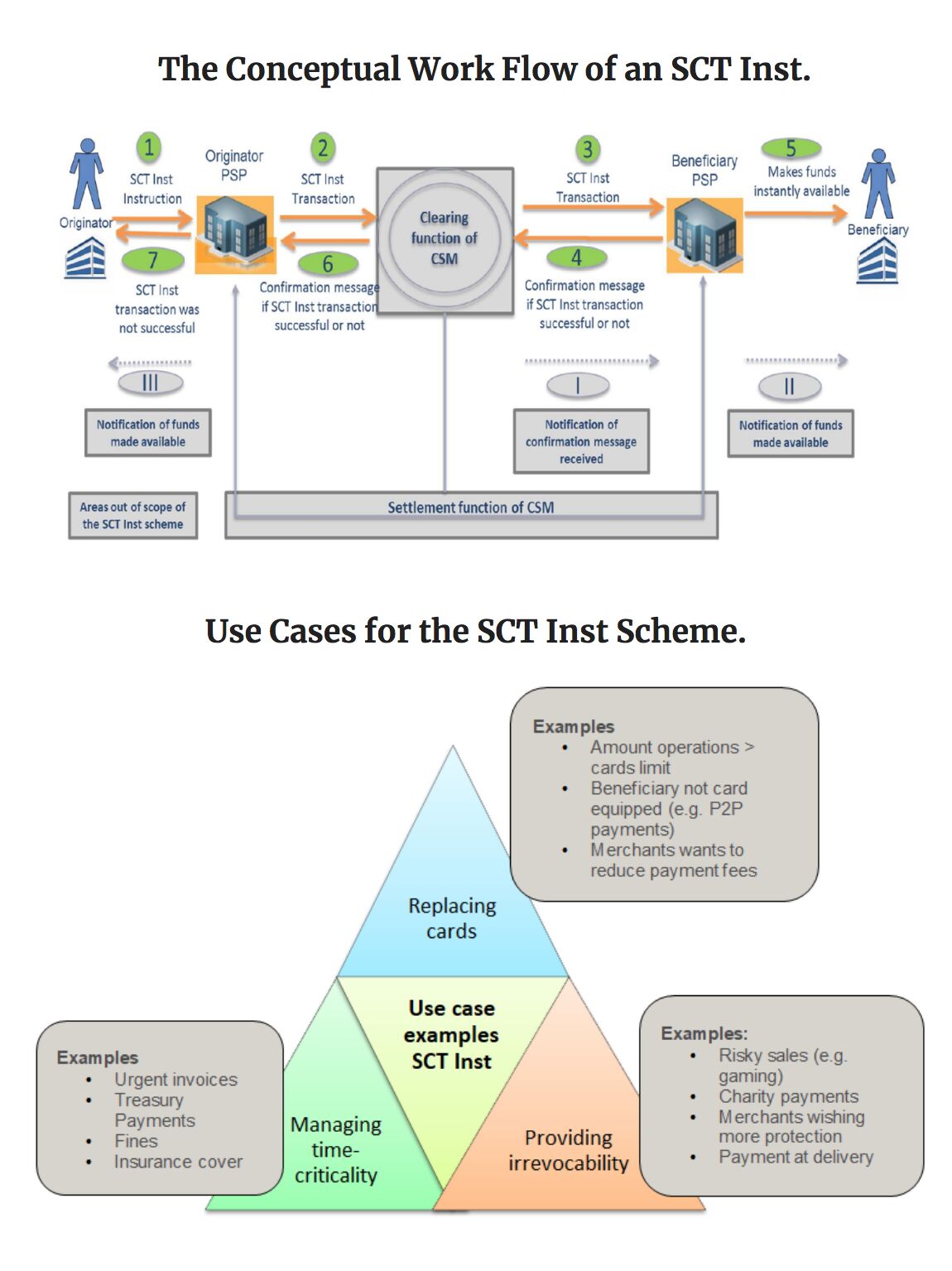

The following infographic illustrates the conceptual work flow of an SCT Inst and some use cases.

There are several benefits this new payment method brings to the table, including a strong reduction of working capital trapped to fund operations.

Much will also depend on some factors such as:

🔹 Can it seamlessly be integrated into the sale process? 🔹 Which additional services will be linked to this type of payment? Retailers might want to combine these payments with their loyalty programs. 🔹 What will be the rate of adoption by both banks? 🔹 How quickly the various CMS systems in Europe will be able to interoperate? 🔹 Which prices the banks will charge for this new payment instrument? 🔹 Will it be possible to combine instant payments with new technologies such as the NFC (Near Field Communication)?

For financial institutions, this will imply major changes, as they need to be able to:

🔹 Make the necessary compliance and KYC checks; 🔹 Do real-time processing and routing; 🔹 Upgrade their current architecture to support SCT Inst; 🔹 Comply with the SLA of the SCT Inst Scheme; 🔹 Allow 24/7/365 operational processes, availability, reporting and servicing; 🔹 Make extra notifications and reach filtering (as the SCT Inst scheme is not mandatory); 🔹 Adapt their fraud/sanctions management systems; 🔹 Adapts their liquidity management processes and monitoring;

We can think that it is a matter of time before instant payments become widely used in Europe. Although financial institutions have a lot of challenges ahead, embracing innovations such as instant payments will be a crucial factor in meeting customers' growing expectations for faster, more secure and more efficient payments. PSD2 could be a catalyst to the development of SCT Inst. Many Fintechs are already positioning themselves to offer their services.

The experts agree that whilst from the start, there will be use cases enabling the SCT Inst to take off, it will take a couple of years before we will see use cases in e-commerce and with the retailers, leading to a progressive mass adoption."

Author

DIGITIZING ASIA, ABN ASIA was founded by people with deep roots in academia, with work experience in the US, Holland, Hungary, Japan, South Korea, Singapore, and Vietnam. ABN Asia is where academia and technology meet opportunity. With our cutting-edge solutions and competent software development services, we're helping businesses level up and take on the global scene. Our commitment: Faster. Better. More reliable. In most cases: Cheaper as well.

Feel free to reach out to us whenever you require IT services, digital consulting, off-the-shelf software solutions, or if you'd like to send us requests for proposals (RFPs). You can contact us at [email protected]. We're ready to assist you with all your technology needs.

© ABN ASIA